Tax Rate Changes from the 2019-20 Budget

A simple budget has been handed down by the Coalition with some much needed tax relief for low to middle income earners as well as small to medium sized businesses. The budget seems favourable and builds on promises made last financial year. Labor has been supportive of tax benefits for lower income earners so this has a good chance of passing Parliament. No matter which party wins the election, there’s more money coming your way at tax time.

Below is some food for thought as you prepare to vote in the upcoming federal election. In the meantime, we are here to answer your questions on anything budget related and how you will be affected so please don’t hesitate to contact us.

For Businesses: Instant Asset Write-Off

From July 1, 2019 the instant asset write-off threshold will increase to $30K for businesses with an annual turnover of less than $50M. This will allow small to medium sized businesses to immediately deduct purchases of business assets costing less than $30K. In addition to this, the annual turnover threshold for what is considered a small to medium sized business is increasing from $10M to $50M opening the door for more businesses to access the instant asset write-off.

For Individuals: Lowering Tax Rates

The government have promised to extend the 19% marginal tax rate and lower the 32.5% marginal tax rate to 30% by 2024-25 hitting the top marginal tax rate at $200K (instead of the current $180K). This works towards abolishing the 37% tax rate moving towards a simpler tax system.

This builds on the changes in last year’s Budget with the following pit-stops beforehand of:

The 19% $37K threshold increasing to $41K in 2021-22 (and the low income tax offset increasing from $445 to $645) on its way to a $45K threshold by 2022-23 and a low income tax offset of $700; and

The 37% threshold of $90K (which increased from $87K in the 2018-19) is set to increase to $120K in 2022-23 before being wiped out altogether under the new 30% simpler tax system with the new threshold range to be $45K all the way to $200K.

For Individuals: Increased Low Income Tax Offset

There will be an increase in the Low Income Tax Offset (LITO), seeing more money back in your 2019 Tax Return and beyond. As indicated below, low and middle income earners will have their tax reduced by up to $1,080 for singles and $2,160 for couples.

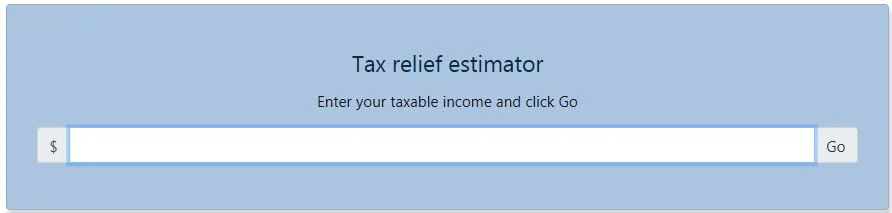

See how this will affect you by using the ‘Tax Relief estimator’ at this link: https://www.budget.gov.au/2019-20/content/estimator/incometax.htm?income=50000. For example:

Lowering Company Tax Rate and Increases to Small Business Discount

The government also plan to lower the company tax rate from 27.5% to 25% by 2021-22. This was already in the works but it wasn’t set to hit 25% until 2026-27 so this has wait time is proposed to be cut down significantly. The standard company rate will remain at 30% for large businesses with a turnover >$50M.

Of course to match this, the unincorporated small business tax discount rate will increase to balance this out for businesses that don’t operate under a company structure. For those operating a business under a different structure to a company, for example as a sole trader.

Labor's Budget Reply

Opposition leader, Bill Shorten has said, “…from the 1st of July, if you earn between $48,000 and $126,000, no matter who you vote for in May, you will get the same tax refund.”

Labor claim they will provide a higher tax refund for 2.9m Australians who will earn less than $40,000.

Here’s more on how it went down on budget night: https://www.yourmoney.com.au/business/economy/how-it-all-happened-on-budget-night/