Royal Commission Crackdown

Have you ever sought financial advice, only to wonder if they’ve really acted in your interest rather than for their own bonuses? The Royal Commission has recently sent the financial industry into a spin, all for the greater good of the people. They’ve stepped up, cracked down and said, enough is enough!

Kenneth Hayne, Royal Commission

The Royal Commission’s inquiry into Misconduct in the Banking, Superannuation and Financial Services Industry has concluded giving APRA and ASIC greater oversight to watch over the financial industry and given expanded powers to the Federal Court to prosecute corporate criminal misconduct in cases brought by the regulators.

It’s been in the works for a while now and APRA finally dragged the banks and other financial institutions through the courts over the last several months, forcing the CEOs to answer for internal incentive targets that encouraged advisers in a manner which did not always benefit the customer.

This crackdown has been one of many factors that has affected the financial markets since October 2018 (not mentioning the US:China trade war or UK’s no-deal Brexit), seeing the banks’ stocks and the financial market overall plummet. If you’re an investor and have been watching, you’ll know what I’m talking about. Now that the dust has settled, sentiment is on the increase and mostly the banks and the market have begun to recover (TBC). However, there are still casualties:

The NAB chairman and CEO have announced their resignation after a history-making shareholders revolt. See the story here: (https://www.abc.net.au/news/2019-02-07/nab-ceo-and-chairman-both-resign-after-royal-commission/10790670).

Recently mortgage broking companies have taken a hit. For one example, stocks in Australian Finance Group (AFG), a mortgage broking group, took a dive to an all-time low on Tuesday 5th Feb 19:

Australian Finance Group (AFG) stock chart from Jan to Feb 19.

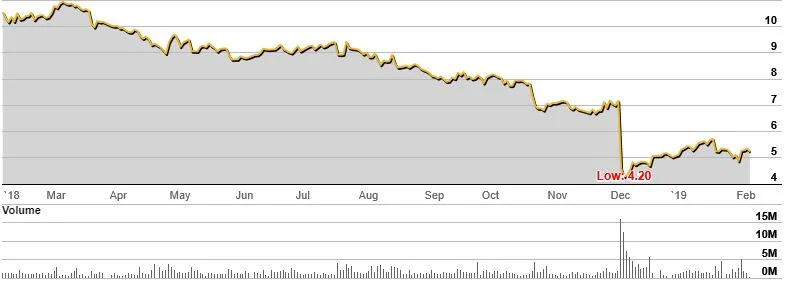

APRA took regulatory action against IOOF Holdings Limited in early Dec 18 to disqualify three executives and two directors from the industry for failing to act in the best interests of superannuation members. No surprise, its stock plummeted that day as shown in the chart below:

IOOF Holdings Limited (IFL) stock chart from Feb 18 to Feb 19.

Overall, this mess is now coming together and it will tighten up the financial industry even further to ensure customers are treated fairly and financial advice given is in the customer’s best interests and not to meet targets.

Here’s a summary of what the final report had to say:

Compensation for Customers

Customers are being offered compensation for investment losses due to known poor financial advice given. When compensation from the financial firm responsible is not possible, it’s proposed the Government will establish a so-called compensation scheme of last resort to allow customers and small businesses to have their cases heard.Fees for No Service

Believe it or not, customers were being charged for services they hadn’t received, some cases even involved people being charged fees after they had died. Compensation from wealth managers and the major banks has been estimated at $850m.

Mortgage Brokers

This will shake the mortgage broking industry. Home loan customers could now be expected to foot the bill once the current commission-based model becomes a “borrower-pays” model. From July 2020, the Government says it will ban trail commissions that a mortgage broker can receive and will conduct a review in three years to consider removing their upfront commissions. Arguably the mortgage broking industry needs more regulation to ensure commissions don't unethically incentivize loans to be placed with certain lenders but mortgage brokers are a service to our community and we fear that if people need to pay for a broker, it could push them to go direct to the banks to save paying a broker fee and end up not receiving the best deal.

Superannuation

In a bid to prevent people being “sold” superannuation products/funds, hawking will be prohibited so people aren’t led to select a product that isn’t in their best interest. Superannuation has always been under strict regulation and now the “powers that be” (APRA and ASIC) will receive extra power by creating civil penalties for breaches by advisers.

Motor Dealers

If you’re buying a car and obtain finance, the interest rates should now be set across the board. The motor dealer can no longer purchase an interest rate from the financier and then apply a mark-up interest rate that they would receive. Plus, the additional products that dealers sell, such as insurance, paint protection, etc, is proposed to move to a deferred sales model so customers can think about whether they need the “up-sells” or not rather than being forced into it during the sale.

Farms and Small Business

Our farmers have long complained about the poor treatment they receive from banks and were a large force in pushing the Royal Commission to make a stand. The banks will now need to mediate with the farmers when a home loan becomes distressed not as a final measure when the lenders take enforcement action. Banks are urged to take possible effects into account that might be needed to sell the land at fair value, if it came to that, when assessing new loans.

Contact us if you’re concerned about how this may affect you, if you feel you’ve been a victim of poor financial advice and could be entitled to compensation or are thinking of refinancing or purchasing a home in the near future.

Royal Commission’s full report here: https://financialservices.royalcommission.gov.au/Pages/default.aspx

APRA: Australian Prudential Regulation Authority

ASIC: Australian Securities and Investments Commission