Tax Rate Changes from the 2020-21 Budget

After all the crazy this year, the Coalition have handed down the (deficit) Budget which includes lower taxes! This part interests us. Read on for our take.

Tax Rate Changes

The welcomed Stage 2 tax cuts have been bought forward from 2022 and back-dated to take effect from last July 2020 which is positive news and will put extra dollars into the pockets of most Australians come EOFY 2021 and in pay-packets moving forward.

The main takeaway is the middle tax brackets have been expanded to allow the lower tax rates to be enjoyed by more earners before jumping a bracket.

The back-dated part of this will be seen in next year’s tax returns but PAYG withholding will need to be adjusted so workers can see this tax cut throughout the year now. Reach out to us for assistance.

Click here to use a calculator to find out how much you’ll save or download the fact sheet!

“Let’s talk $$$. What does this actually mean for me this year?”

It means a higher tax refund (or a lower tax bill) at tax time next year to make up for the last 3-4mths since July and an increase in your net pay soon to meet the new tax rates.

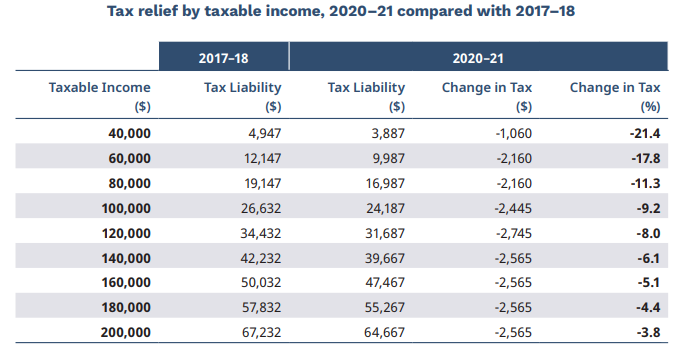

Here are some examples on how you could save tax, based on your taxable income compared to the past.

Projecting ourselves into 2025 to see where they’re heading, see the below table. Main differences are the abolished second-highest tax bracket and full expansion of the middle bracket to now include earners between $90K to $200K at a lower 30% before the highest bracket kicks in for high income-earns over $200K/year.

Job-Maker

Another incentive announced to encourage employers to help ease Centrelink’s JobSeeker system and reverse an increase in youth unemployment is the introduction of the Job-Maker plan. For hiring a JobSeeker recipient (receiving payments for at least 3mths) before 06/10/2020, businesses could receive up to:

$10,400 in the form of $200 per week for a year for having created a job for an employee aged 16-29; and/or

$5,200 in the form of $100 per week for employees 30-35.

To be eligible, employees hired need to have:

Received at least one month’s JobSeeker payments from Centrelink within the last three months before they were hired.

Worked at least 20hrs per week.

Commenced employment between 7 October 2020 and 6 October 2021.

This is available from 07/10/2020 paid in arrears from the ATO, similar to JobKeeper.

Stimulus Updates

Other updates to the stimulus measures:

JobKeeper 2.0. Need we say more. Read our article here.

Centrelink’s Coronavirus Supplement has been extended until 31st March 2021 but at a reduced rate of $250 per fortnight from 25th September until 31st December 2020;

Then an extra $150/fn until 31st March 2021.

There will be two additional support payments of $250 to pensioners and other eligible recipients from Centrelink. Those unlikely to receive the Coronavirus Supplement.

Attention and money will be spent in order to give the elderly greater access to home care rather than nursing home care. A great initiative after seeing what’s happened.

Click here to read more on the stimulus releases from the craziness this year.

Instant Asset Writeoff

Larger businesses will now benefit from the instant asset write-off with the eligibility turnover lifted to $5b which basically includes most, if not all, businesses except the banks.

Small and medium sized business will continue to benefit from claiming 100% of any asset purchase up to $150K straight away which is already in place.

The $150K instant asset write-off threshold was originally set to reduce back down on 30/06/2020, then was extended until 31/12/2020, has been given another six months so businesses now have until 30/06/2021.

All in the aim to encourage businesses to purchase equipment with the prediction it will create 10’s of thousands of jobs and keep the ferris wheel spinning.

Loss Carry-Back Provisions

A new but temporary initiative will see struggling businesses (corporate entities with a turnover less than $5b) who suffer a loss in the 2020, 2021 or 2022 financial year but made a profit in a previous year (back to 2019) to be able to claim a refundable tax offset up to the amount of the previous income tax liabilities.

This will put previously paid tax back into the pockets of businesses and support their continued growth. Usually business losses can only be carried forward to be offset against future profits. This allows the clock to be turned back due to the COVID effects to business.

A big tax planning edge!

More Info and Support

As always we are here to support and guide you through this recession, please contact us if you wish to discuss any of these measures further or are wondering how they will effect you.

For support:

https://www.ato.gov.au/Media-centre/Media-releases/Support-measures-to-assist-those-affected-by-COVID-19/

All taxpayers affected by the Coronavirus outbreak can contact the ATO for assistance on the support line 1800 806 218.